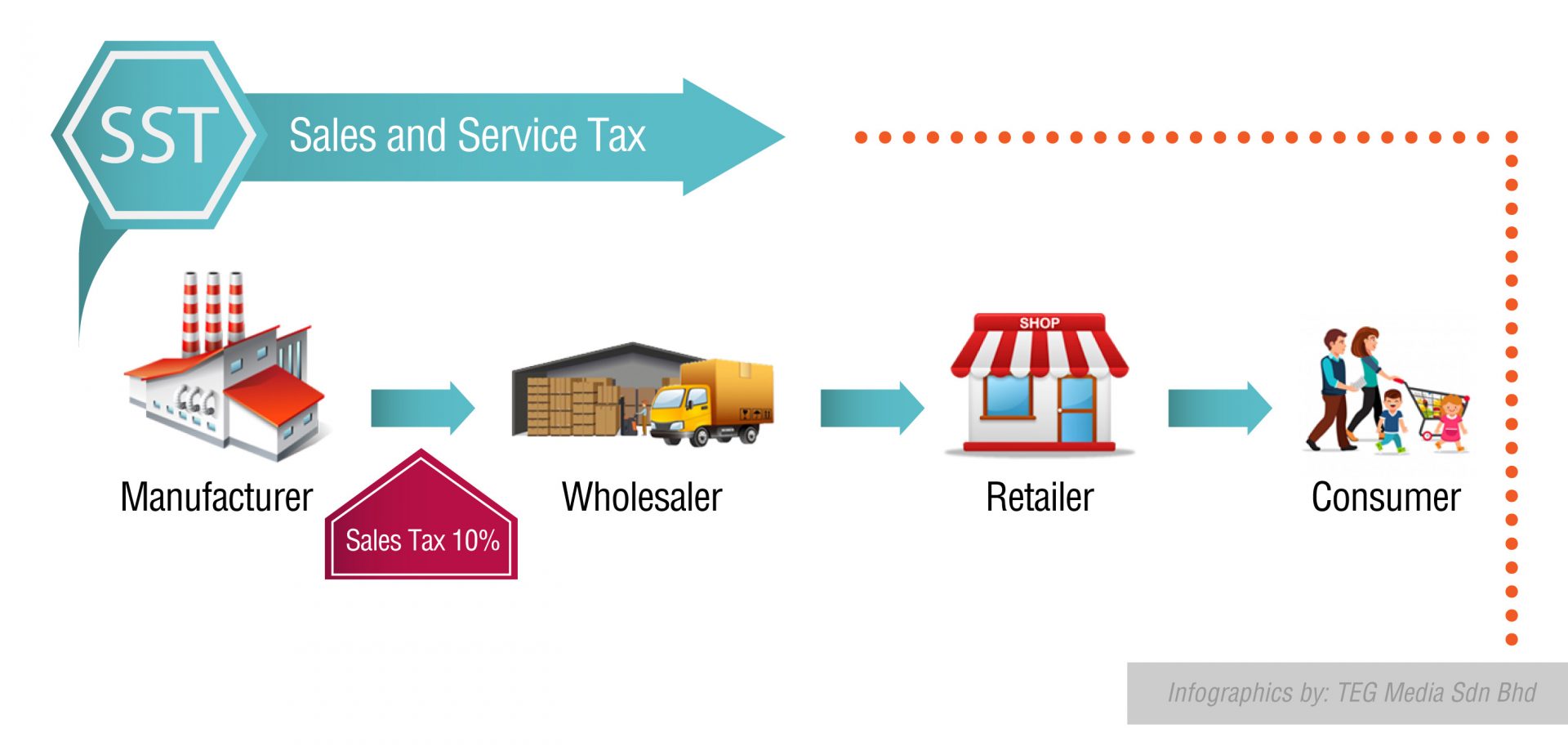

If the authorities can oversee this matter. It is a single stage tax imposed on factories or importer at 10.

Gst Vs Sst In Malaysia Mypf My

THE introduction of sales and service tax SST in Malaysia has been talked about since the early 1980s when a group of civil servants from the Treasury and.

. Their sales price of a product is set at RM 5500 where RM 500 is SST which is RM 200 more than its price of RM 5300 set during the era of GST in Malaysia. The new sales tax will be imposed at a rate of either 5 10 or a specific amount will be for petroleum products. Now as you have a concept on Malaysian service tax lets get back to SSTSST or Sales and Service Tax SST in Malaysia are generated and goes to the national treasury from the general service providers in Malaysia.

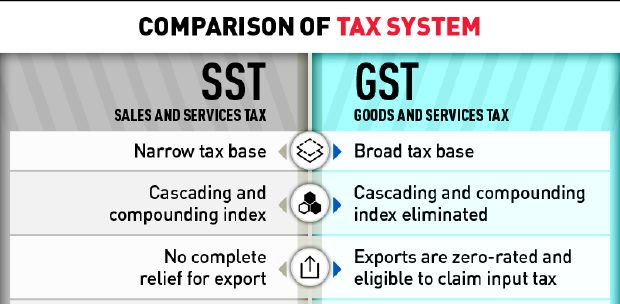

Malaysia reintroduced the Sales and Services Tax SST to replace the Goods and Services Tax GST beginning 1 September 2018. The Advantages of GST. TMF Group in Malaysia.

For businesses GST claim back on tax has been difficult can be declined and requires a minimum of RM500. For retailers GST will not be a cost incurred which means that there will be. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be registered for the tax which is levied at rates varying from 5 to 10 depending on the goods in question.

Exempted from SST registration are tailoring jewellers and opticians. Therefore the wholesellers and retailers do not need to pay this tax no need to prepare quarterly tax submission as required under. The advantages for SST are.

GST has drawn quite a bit of flak over the years and public opinion is generally that GST has caused prices of goods and services in Malaysia to go up without the country seeing significant benefits to the additional tax revenue collected. The sales tax was at 10 and service tax was at 6 respectively prior to being replaced by GST in. It is a single-stage tax which means that an amount is charged on taxable goods which are manufactured and sold by any taxable person s in the country.

Companies who are SST-registered must file a report every two months. Monday 23 Jul 2018 1236 PM MYT. With Pakatan Harapans win over the GE14 Elections the return of the Sales and Service Tax SST after the 3-year implementation of Goods and Services Tax GST had been widely discussed.

First lets take a look at the good things that the GST has brought forth since its inception in Malaysia. SST is the new tax introduced in Malaysia on 1 September 2018 and referred to as Sales and Service Tax SST. They are liable to register for this service tax under the 2018 Act.

At time of writing the list of items exempted from SST is still being revised taking feedback into consideration and will only be finalised by the end of the year. Impact of SST on Malaysias Economy. The SST-02 return must be submitted no later than the last day of the month following the end of the taxable period which means first returns are due by 30 November 2018.

The service tax rate will be 6. Answer 1 of 2. SST tax rate is set at 5 and 10 for sales and 6 for services.

The first taxable period will be from September to October 2018. RM 5000 RM 1000 RM 4000. A 6 rate has been fixed for SST by the Ministry of.

Its profit margin remains unaffected. Although more goods and services are exempt from sales tax than GST the number of. Goods and Service Tax in Malaysia is a single taxation system in the economy levied on all goods and services in the country.

All the goods and services offered in the country would be charged at 6 tax. SST to give consumers higher purchasing power. The earlier taxation structure ie sales and service tax which was 5-15 was reduced to 6 by GST implementation in Malaysia.

The decision was made to encourage new car purchases which will drive the growth of the countrys automotive sector and the overall economy. SST in Malaysia and How It Works. It is extended for another six months from 1 January to 30 June 2022 for new CKD and CBU cars.

RM 4000 RM 5000 x 100 80. Both taxes are single-stage taxes whereby the sales tax Sales Tax Act 1972 is typically charged at the manufacturers level while the service charge or tax Service Tax Act 1975 is charged at the consumers level except at tax-free zones. The SST exemption is for all passenger vehicles including MPVs and SUVs but does not include trucks that.

KUALA LUMPUR July 23 The Sales and Services Tax SST set to take effect on Sept 1 is poised to be beneficial for the people as it will enable them to cope with the cost of living better. It was one of the most memorable promises made by the new Prime Minister Mahathir Mohamad to Malaysias citizens. The purchasing power of Malaysians will be boosted with the re-introduction of the Sales and Services Tax SST in September said KPMG Tax Services Sdn Bhd Indirect Tax Advisor Datuk Tan Sim KiatHe said the SST was a single level tax compared with the just zero-rated Goods and Services Tax GST which was charged at every stage of business transaction.

GST can help the diversification of income sources for the government instead of just relying on income tax and petroleum tax alone.

Comparing Sst Vs Gst What S The Difference Comparehero

Gst Better Than Sst Say Experts

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Gst Better Than Sst Say Experts

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Advantages Of Sst 3 Advantages Of Sst In Malaysia Malaysia Replaced The Goods And Services Tax Studocu

Sst Vs Gst How Do They Work Expatgo

Sst Vs Gst How Do They Work Expatgo

Gst Vs Sst Which Is Better Pressreader

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst Better Than Sst Say Experts

Gst Vs Sst In Malaysia Mypf My

Summary Of Advantages And Disadvantages Of Utilizing Various Sst To Download Table

Advantages And Disadvantages Of Sst Malaysia 2019 Business Setup Worldwide

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

The Move From Gst To Sst Mcmillan Woods

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Sst Vs Gst Here Are 5 Things That You Need To Know

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog